IoT analytics and smart energy

How I assessed the UK Electric Vehicle charging market opportunity for a leading service monitoring company for connected devices

1. Introduction

In this consulting project, I assessed the growth opportunity in the UK Electric Vehicle (EV) charging market for the CEO of a Europe-wide leading service monitoring company for connected devices. I analysed the market opportunities in the UK EV charging market, assessed the customer needs and pain points, and derived potential strategies in the IoT analytics and smart energy market.

The Europe-wide leading service monitoring company for connected devices is a B2B SaaS company providing service monitoring tools for companies deploying IoT devices. The company offer service monitoring, management, and automation for connected devices to transform their customer’s service quality with no-code incident management, performance analytics, and business process automation.

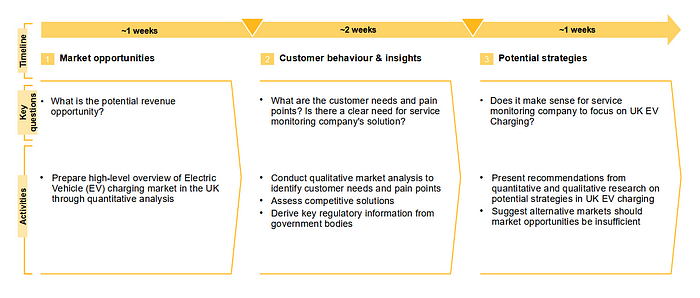

Project plan

The CEO asked me to analyse the viability of the Electric Vehicle charging market in the UK for the service monitoring company, in the context of a potential capital raise next year.

Research methodologies

1. Qualitative Analysis

Objectives. Identify customer needs, pain points and desire for the service monitoring company’s solution

2. Quantitative Analysis

Objectives. Forecast potential revenue opportunity in UK EV charging

2. Qualitative Analysis

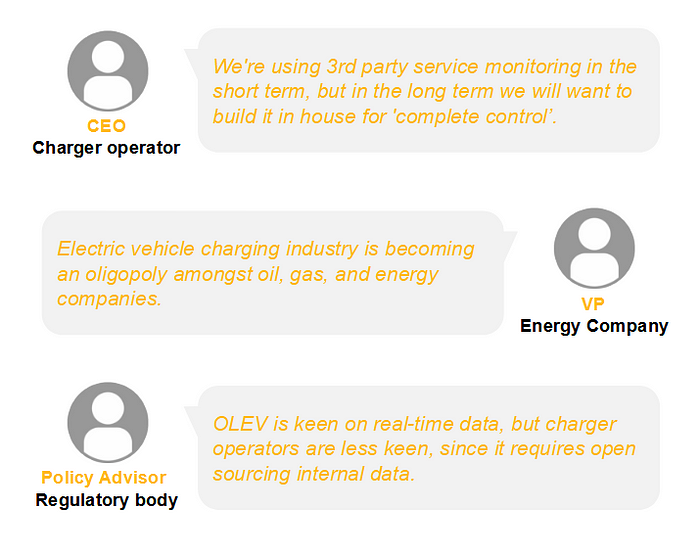

Qualitative interviews

10 semi-structured interviews conducted

Interview results and pain points

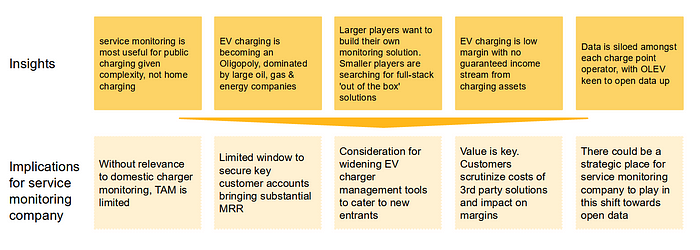

Semi-structured interviews provided following insights

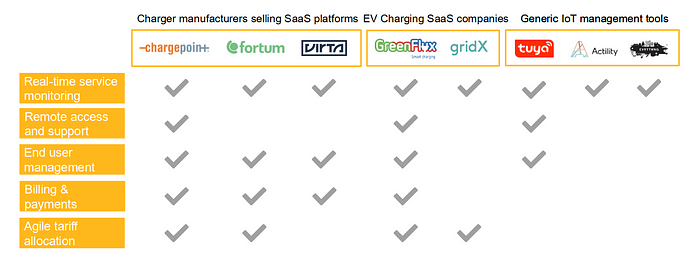

Competitor Analysis

The service monitoring company’s competitors fall into three main buckets, offering a variety of services across the EV software value chain.

3. Quantitative Analysis

UK EV market sizing — short, medium and long-term forecasts

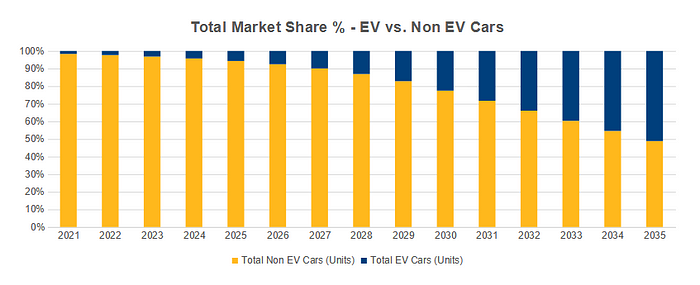

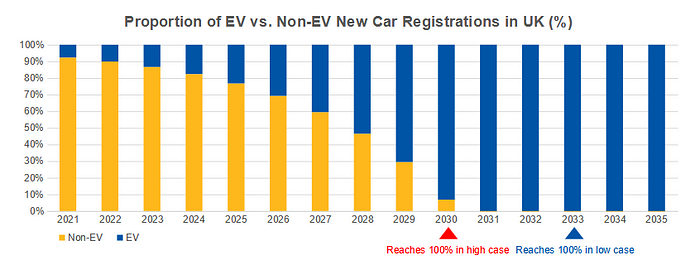

While car sales are declining at ~1.7% per year, EV is forecasted to grow at ~30% annually. The House of Commons mandates that, by 2035, 100% of new cars will be EV and EVs comprise 50% market share. My model simulates by 2030 EV will constitute ~93% of new car sales and by 2035 will have between 51–52% of market share.

Sometime in the mid 2020s, the price of an EV will become cheaper than a non-EV car, hence an exponential uptake is justifiable.

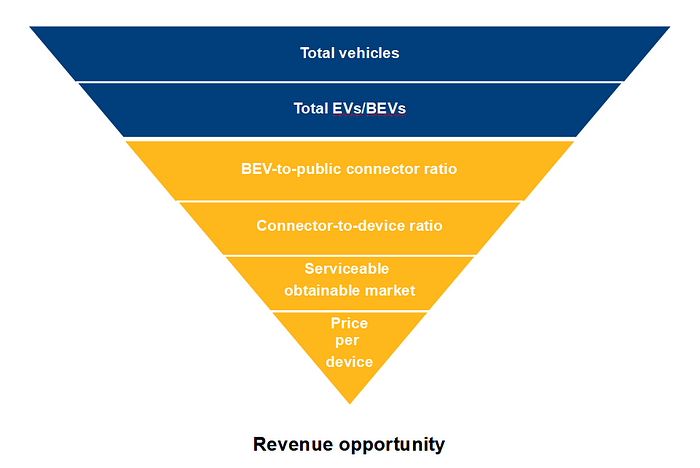

Revenue opportunity sizing — Quantitative model structure

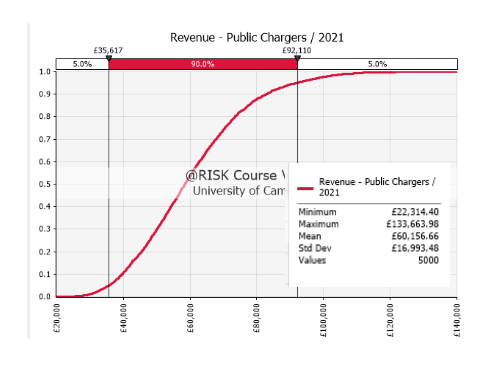

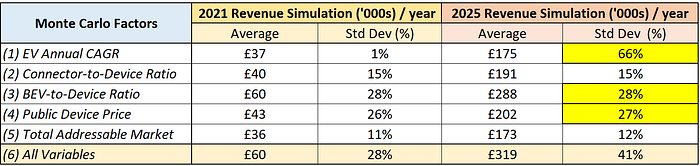

Revenue Analysis — Monte Carlo Simulation on public device revenues

The EV smart-charging market has a lot of uncertain moving parts. A Monte Carlo simulation was employed to predict the probability of different revenue outcomes. The analysis was done on public chargers only given the difficulty for service monitoring company to tap into private chargers in the short-to-medium term.

Tested variables

- New EV CAGR

- Connector-to-device ratio

- New passenger car CAGR

- BEV-to-connector ratio

- Service monitoring company’s serviceable obtainable market

- Price per device

Short-term revenue potential

- Likely annual revenues between £36 to £92k, averaging at £60k

Mid-term revenue potential

- 20% chance of getting £35k MRR

- Most likely revenues at £320k/yr or £27k/mo

- High standard deviation indicates high market uncertainties

Monte Carlo and Sensitivity Analysis

By assessing variables with the highest standard deviations, the following “sensitive” variables are identified.

- EV annual growth rate. Influenced by government regulations and subsidies

- BEV-to-device ratio. Influenced by government mandates to install a certain number of public chargers

- Price/public EV charger. Influenced by a mix of service monitoring company steer and customer willingness to pay

Key takeaway. The factors affecting service monitoring company’s revenues are mostly outside the company’s circle of influence.

4. Recommendations

Synthesis

Qualitative Analysis

The EV charging oligopoly is forming under oil, gas and energy majors, who are planning to deploy own monitoring solutions. Smaller players are concerned about low margins and expressed interest in maximising functionality from 3rd party tools.

Quantitative Analysis

Given the many moving parts, the service monitoring company has a 20% chance of achieving its £35k MRR targets by 2025. The factors most likely to influence service monitoring company’s revenues are mostly outside its control

Market conclusion

The UK EV charging market does not present a large enough revenue opportunity to warrant service monitoring company’s sole focus

Strategic considerations

Given the small market size and the high number of competitors providing software to EV charge point operators, strategic consideration should be given to expanding services horizontally or vertically. I believe that the most sensible expansion opportunities exist horizontally by moving to connect more IoT devices in the smart energy ecosystem with service monitoring company’s current capability.

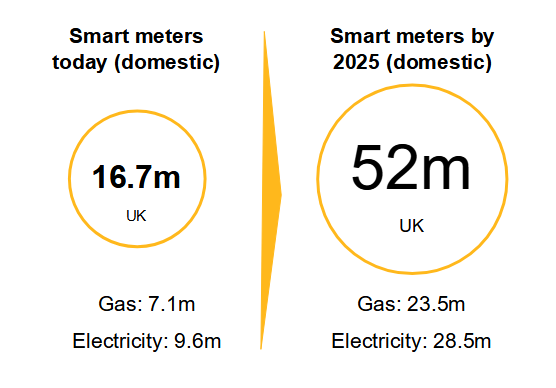

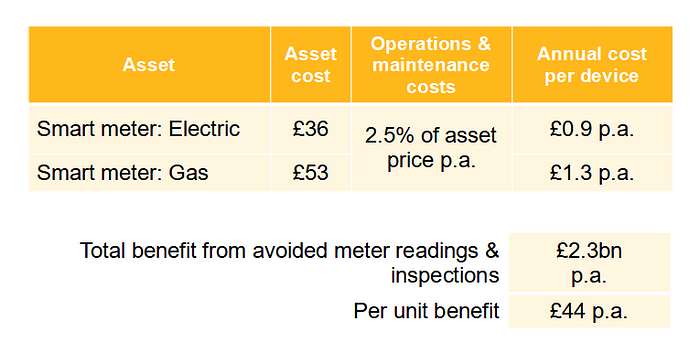

Exploring new assets: Smart meters

Capitalising on IoT devices in other smart energy verticals will boost TAM for service monitoring company, with smart meters presenting a strong potential business case.

“From July 2021, suppliers must comply with a new regulatory framework for the [smart meter] rollout…binding annual installation targets for suppliers and will run until mid 2025.” — Office for Gas and Electricity Markets (2020)

5. Conclusion

- The UK EV charging market does not present a compelling revenue opportunity for service monitoring company to solely focus on.

- The primary revenue accounts the service monitoring company could win in the UK EV charging market are shifting into an oligopoly, most of whom wish to build their own solutions in-house.

- With a capital raise in sight next year, other smart energy assets hitting critical mass such as smart meters may present stronger potential revenue opportunities for service monitoring company.

6. References

Auto Vista Group, 2020. Autovista Group forecasts 20% decline in UK new-car registrations in 2020. [Online] Available at: https://autovistagroup.com/news-and-insights/autovista-group-forecasts-20-decline-uk-new-car-registrations-2020

Department for Business, Energy & Industrial Strategy, 2020a. Smart Meters In Great Britain, Quarterly Update September 2020. [online] GOV.UK. Available at: <https://www.gov.uk/government/statistics/smart-meters-in-great-britain-quarterly-update-september-2020>

Department for Business, Energy & Industrial Strategy, 2020b. Smart Meter Roll-Out: Cost-Benefit Analysis (2019). [online] Assets.publishing.service.gov.uk. Available at: <https://assets.publishing.service.gov.uk/government/uploads/system/uploads/attachment_data/file/831716/smart-meter-roll-out-cost-benefit-analysis-2019.pdf>

EVAdoption, 2019. What Is The “Minimum Acceptable” Ratio Of EVs to Charging Stations?. [Online] Available at: https://evadoption.com/what-is-the-ideal-ratio-of-evs-to-charging-stations/

FleetNews, 2020. Ratio of charge points to EVs revealed. [Online] Available at: https://www.fleetnews.co.uk/news/environment/2020/01/13/ratio-of-charge-points-to-evs-revealed

Hirst, D., 2020. Electric vehicles and Infrastructure, London: House of Commons Library.

Statista, 2020. Ranking of new passenger cars registered in the UK 2013–2019, by segment. [Online] Available at: https://www-statista-com/statistics/299219/popularity-of-different-car-segment-types-sold-in-the-united-kingdom/

Statista, 2020. Number of licensed cars in the United Kingdom (UK) from 2000 and 2019. [Online]

Available at: https://www.statista.com/statistics/299972/average-age-of-cars-on-the-road-in-the-united-kingdom/

The Office of Gas and Electricity Markets, 2020. Smart Meter Rollout: Open Letter On Energy Suppliers’ Progress, Future Plans And Regulatory Obligations. [online] Ofgem.gov.uk. Available at: <https://www.ofgem.gov.uk/system/files/docs/2020/06/open_letter_2020_smart_rollout_progress_and_forward_look.pdf>

Zap-Map, 2020. EV Charging Stats 2020. [Online] Available at: https://www.zap-map.com/statistics/

Thanks for reading! Liked the author?

If you’re keen to read more of my Leadership Series writing, subscribe and get an email whenever I publish an article of this weekly newsletter.