Designing for social change to create shared value innovation

Should all firms pursue shared value innovation? It depends

Every firm in the world can change how it thinks about creating value in the world. If the primary bottom-line of firms changes to a mix of social and financial factors, then their businesses will be able to deliver a more sustainable and equitable growth for all stakeholders.

Social Entrepreneurship not always a solution

Firms realize that social problems present both daunting constraints to their operations and vast opportunities for growth. If the purpose of a firm becomes about solving a social problem, then in some cases they can be limited in being able to create shared value innovation. Social Entrepreneurship can be a huge force in creating social and financial value together, however it might not always be a solution for solving every social problem. Looking at the structure of how different impact organisations function some social problems might require a governmental or policy approach to be solved, while some issues that need immediate attention and social amelioration need to be handled by Non-Profit organisations.

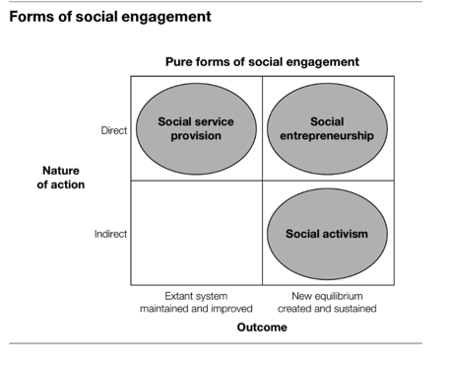

The book “Getting Beyond Better” creates a framework through which impact firms and social organisations can be segregated by. First is by nature of action with stakeholders or customers, which can be direct or indirect and the second is outcome of actions or impact made, which can be incremental or transformational (Martin and Osberg, 2015). This shows that business cannot be the only way to address societal issues.

Multi-sectoral collaboration to solve systemic problems

Complex systemic problems thriving in the society need a more multi-sectoral collaboration and approach to be addressed and solved. Climate Change or inequality cannot just be taken up and solved by firms alone. It would require multi-sector stakeholder partnerships to create change. Just because every firm adapts shared value innovation, there is not a possibility of social or environmental problems being solved. Therefore, all firms shifting towards shared value innovation do not necessarily solve world’s societal issues.

Shared value innovation not the best way for every type of firm

There are certain firms or certain organisations that cannot always balance social impact with financial gains. Advocating for such firms to follow shared value innovation will be difficult. Given the globalisation of supply chains and the complexity at which they operate, every business will not be able to directly correlate its activities to solving a social problem. Not every business can be socially motivated, however, each of them can operate with a sense of social responsibility.

Some firms might also be able to find their purpose in the work they do, evolve a set of codified values that become an integral part of every decision they make. That is a responsible way of engaging in business with all stakeholder interests in mind. Therefore, following shared value innovation is not the best way for every type of firm to balance financial and social objectives.

Accumulation of wealth and redistribution is more impactful

For both individuals and businesses, the accumulation of significant wealth up front and then redistributing it is more impactful than pursuing a joint approach of simultaneously distributing wealth as it is being earned.

For example, Bill Gates is the perfect example of this approach. He is the most impactful philanthropist of all-time (Forbes, 2023). The impact is a result of the sheer quantity of his wealth available to redistribute. However, the first part of his career at Microsoft had almost no regard for a shared value approach. He accumulated an inconceivable amount of wealth via Microsoft in his early life, disregarding any redistribution of his wealth at the time. Following his career at Microsoft and his significant accumulation of wealth, he has redistributed it and has been the most impactful philanthropist of all-time. Had he distributed his wealth simultaneously while growing Microsoft and redirected Microsoft’s focus to a shared value structure, his impact as a philanthropist would not have been even remotely close to the same effect.

The focus of the debate should be more geared around how can we incentivize businesses to grow to their maximum potential and then redistribute their wealth once it has ability to make a material change in the world and on society.

Businesses work in cohesion but no driver for equitable world

Milton Friedman put it very succinctly when he said that no single person in the world could produce a pencil just by themselves (Friedman 1980). He was talking of course about the vast number of resources that go into creating the pencil. Mining for ore, the wood for the pencil, the engineering done at scale to ensure its profitable and so on. The point here is that businesses require many other parts of their supply chains to work in cohesion to ensure a product reaches the market. However, given the impact that endless production has had on our economies it is foolhardy to think that profit motive is the driver for creating an equitable world for us to live in.

Businesses see success by being in the impact space

Today, businesses have seen a large amount of success by being first movers in the impact space. For instance, the social media traction that Brewdog got by offering to create sanitizers using their production and access to alcohol gave it a real boost in terms of marketing ROI as well (Brewdog, 2020). Just recently Pandora promised to use only lab grown diamonds in its lines, thereby reducing in some way the troubling impact that diamonds have had in creating strife, famine, and war (Pandora, 2020). These are big name brands though, and not all small brands can do the same, thus the focus should be on creating a framework to identify how much growth can be created and when businesses can start giving back to society.

Collective Impact to run businesses and create impact

This agenda of businesses where they can run their businesses and create impact in the real world is referred to as “Collective Impact” (Kania and Kramer, 2011). Businesses bring essential assets to collective-impact efforts. They know how to define and achieve objectives within a limited time and budget. They understand change management and the art of negotiation. And corporate pragmatism, accountability, and data-driven decision making can cut through the red tape and ideological disagreements that often get the better of governments and NGOs. This shared focus can help change the world for the better.

Pursuing shared value to profit from government taxation

Pursuing shared value for a firm is important in that a firm may profit from government taxation. In Bangladesh, for instance, most banks and non-financial institutions contribute to the alleviation of social problems while receiving tax exemption (Islam and Hossain, 2019). However, this is not because they voluntarily pursue and create shared value to solve the social issues, but because they would prefer to concentrate on their behaviour in self-interest that can harm the social value and be a route to aggressive tax avoidance and lobbying for less regulation (Crane et al., 2014). Benefits from pursuing shared value may be seen as low-hanging fruits to firms, which may lead firms not to virtually focus on solving actual environmental and societal problems. Further, the benefits may lead firms to avoid paying proper taxes and may motivate them to lobby the government regulatory agency.

References

Brewdog (2020) Business as a forge for good https://www.brewdog.com/blog/business-as-a-force-for-good

Crane, A. et al. (2014) Contesting the Value of “Creating Shared Value” https://core.ac.uk/download/pdf/28904863.pdf

Forbes (2023) America’s Most Generous Givers 2023: The Nation’s 25 Top Philanthropists https://www.forbes.com/sites/randalllane/2022/07/13/exclusive-bill-gates-reveals-how-he-and-ex-wife-melinda-came-together-for-blockbuster-20-billion-gift-that-makes-them-worlds-biggest-givers/?sh=35f906635a8c

Friedman, M. (1980) I, Pencil https://youtu.be/67tHtpac5ws

Islam, M.R. and Hossain, S.Z. (2019) Conceptual mapping of shared value creation by the private commercial banks in Bangladesh https://ajssr.springeropen.com/articles/10.1186/s41180-019-0024-8

Kania, J. and Kramer, M. (2011) Collective Impact. Large-scale social change requires broad cross-sector coordination, yet the social sector remains focused on the isolated intervention of individual organizations https://ssir.org/articles/entry/collective_impact

Kramer, M.R. and Pfitzer, M.W. (2016) The Ecosystem of Shared Value https://hbr.org/2016/10/the-ecosystem-of-shared-value

Li, J. and Garnsey, E. (2012) Social Ventures as Innovators at the Base of the Pyramid

Martin, R.L. and Osberg, S. (2015) Getting Beyond Better: How Social Entrepreneurship Works

Pandora (2021) Pandora launches lab-created diamond collection https://pandoragroup.com/investor/news-and-reports/press-releases/newsdetail?id=24186

Thanks for reading! Liked the author?

If you’re keen to read more of my Leadership Series writing, subscribe and get an email whenever I publish an article of this weekly newsletter.